Federal Rehabilitation Tax Incentive Program

For owners of income-producing historic properties, there are also federal rehabilitation tax credits. The federal program is managed by the National Park Service, but applications are first submitted to the State Historic Preservation Office, within the Division of Historical and Cultural Affairs.

Frequently Asked Questions

Get Answers to FAQ about the program, such as

Who may apply?

What buildings are eligible?

How do I find out if my property is eligible?

What are qualified expenses?

Are there any deadlines?

How are credits calculated?

What are the fees?

And more…

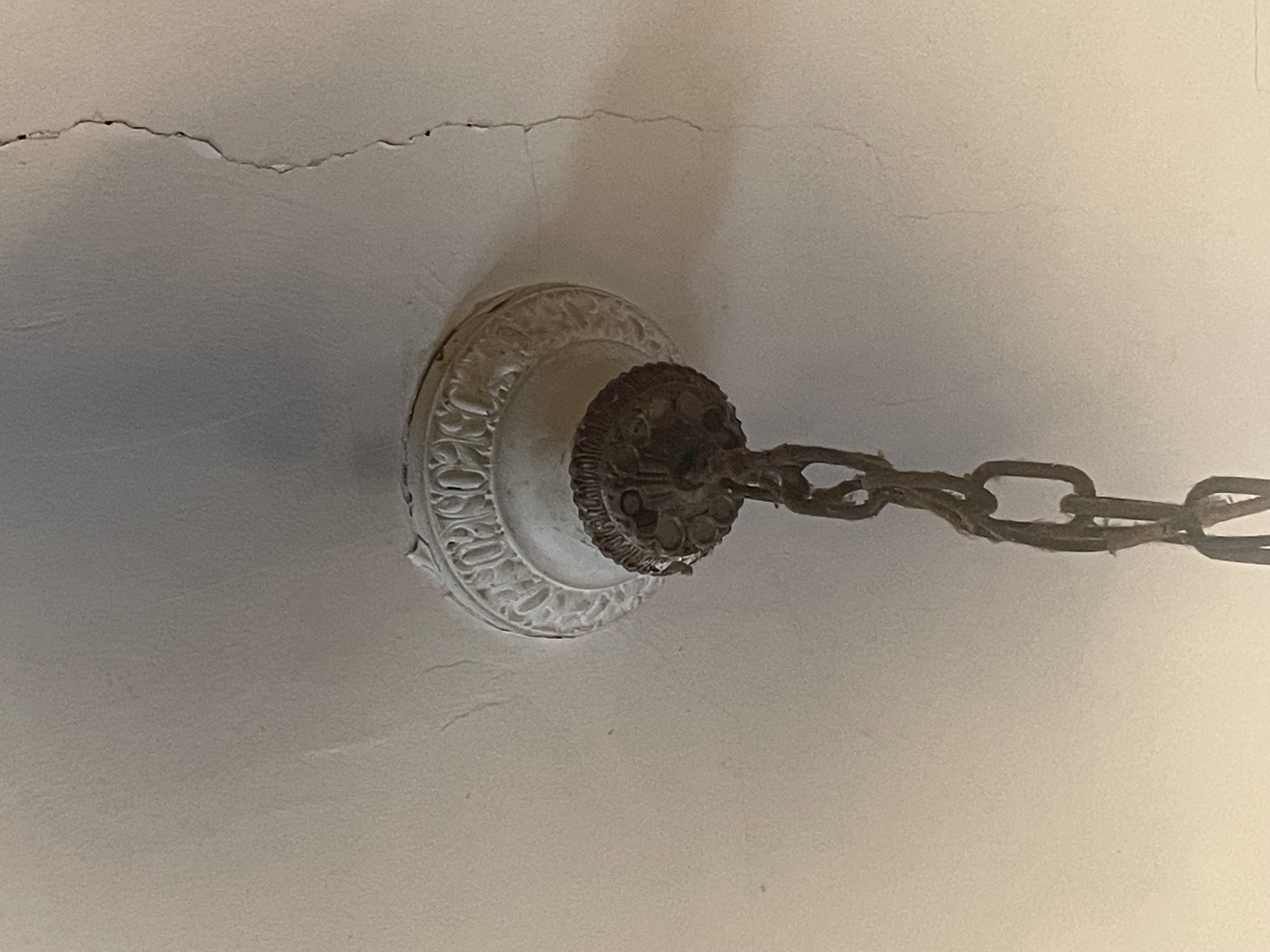

Guidance on Rehabilitation Standards for Historic Buildings

Rehabilitation work must meet the Secretary of the Interior’s Standards for Rehabilitation to be eligible for historic preservation tax credits. Our Guidance document offers definitions and specific examples of how to best carry out common types of repair work to help ensure projects' success.